Ready to connect with a solar installer?

Contact us to get connected with a solar installer near you.

A question often asked by installers and homeowners alike is, “How do I maximize the performance of my batteries?”

First and foremost, the batteries require installation as per the environment and operating parameters specified in the battery manual. Secondly, the power conversion equipment, batteries, and load must all be sized to match. The cables and connectors, often overlooked when setting up the system, are vital. And lastly, the batteries must communicate the battery status to the power conversion equipment in a closed-loop configuration to maximize charging efficiency and the life of the battery.

The installation location is very important for the battery to operate at its full potential.

Installing the batteries in a location that meets the documented environmental specifications is mandatory. But further to that, the battery runs more efficiently if used at moderate temperatures and not in the extremes of any of the temperature ranges. Operating batteries at an ambient temperature between 15 and 20 oC (59 to 68 oF) is optimal.

Other environmental considerations include the climate of the environment. Add dehumidifiers and fans to keep the batteries dry in wet, humid environments. Add heating in extremely cold environments. Add cooling in extremely hot environments. Keep the batteries and equipment clean and free of dust and debris.

Considering the increased frequency of weather events, evaluate how that could impact the batteries. Add appropriate drainage and ensure batteries are installed well above the ground to protect batteries from flood water. To protect batteries from tremors and potential earthquakes, install them on a solid surface and attach wall straps to secure the batteries to a frame.

The placement of batteries can also influence performance, as well as safety. The location should include good airflow with space between the batteries, walls, and ceiling. Also, batteries should be installed away from living quarters and away from any sources of heat.

The power conversion equipment has charge current and output current ratings. There should be enough batteries to handle the charge current, as well as handle the load requirements of the system, whether it be the whole home, specific appliances, or other loads.

The first thing to calculate is the load requirement. Appliances have energy guidelines. If possible, also identify their peak loads. Lightbulbs define their energy usage in watts (per hour). And if you use an EV charger, review its energy rate information. Total all these values to get the load requirement in the home.

Configure enough batteries to handle the power converted by inverter-chargers, and configure enough batteries to handle the load, whether it be the whole home, specific appliances, or other loads.

The installation should also take into account the cables and connectors. Whenever possible, use manufacturer-recommended and UL-rated cables and connectors. The cables and connectors should be of high quality and capable of handling the voltage and current generated by the power conversion equipment and batteries. Without correctly sized cables and connectors, the system can overheat.

The length of the cables between all the components in the Energy Storage System (ESS) should be as short as possible by locating the batteries close to the power conversion equipment. You can minimize the resistance, voltage drop, and other electrical issues with good, short cables and secure connectors.

Perhaps the most important component that enables Lithium batteries to run efficiently is closed-loop communication between the Battery Management System (BMS) and the power conversion equipment. By using closed-loop communication, the power conversion equipment adjusts the energy delivered to batteries depending on the battery's current State of Charge (SOC), cell temperature, and voltage.

There are many things installers and homeowners can do to maximize the performance of their batteries. First and foremost, install the batteries as per the environment and operating parameters specified in the battery manual. Secondly, the power conversion equipment, batteries, and load must all be sized to match. The cables and connectors must also be sized for the system. And lastly, the batteries must pass battery information, such as the battery SOC, temperature, and voltage, to the power conversion equipment to maximize charging efficiency and maximize the life of the battery.

In the ongoing fight against the climate crisis, clean energy tax credits, such as the Investment Tax Credit (ITC), play a crucial role. These tax credits pack a big punch for homeowners looking to adopt cleaner and more sustainable energy solutions, including solar power and solar power plus storage systems.

Part of President Biden’s Inflation Reduction Act (IRA), the ITC, along with other tax incentives, holds the potential to steer the United States toward a cleaner, more sustainable energy future. Initial estimates foresaw the IRA contributing at least $370 billion to climate action, with $257 billion earmarked for tax credits. However, recent reassessments suggest that these projections might be conservative, hinting at the possibility of these investments being three times more substantial. For those who choose to take advantage of the ITC, the sky is the limit, as there are no value or lifetime caps.

The ITC facilitates new investment in clean energy installations by allowing individuals and corporations to reduce their tax liability by 30% of the investment's cost. This reduction is dollar-for-dollar; for example, claiming a $1,000 federal tax credit would reduce federal income taxes due by $1,000. If the credit exceeds tax liability for the year, the unused portion can be “rolled over” to future years so long as the credit remains in effect. A diverse range of projects are eligible for the ITC, including manufacturing, energy efficiency, and renewable energy initiatives (such as solar power systems).

To qualify for the baseline 30% credit, the project must meet the following requirements for labor standards:

ITC Eligibility Criteria: Who Can Benefit?

The beauty of the ITC lies in its accessibility. Unlike some incentives that cater exclusively to corporations, the ITC can be claimed by a wide range of entities, including individuals, nonprofits, and households. For homeowners, the ITC opens doors to reducing tax liability, making solar energy not only an environmentally conscious choice but a financially savvy one as well.

The ITC can be claimed for improvements to a primary residence, regardless of whether the applicant rents or owns. It's important to note that landlords or other property owners who do not reside in the home are ineligible to claim the credit.

Eligibility Criteria: How to Leverage the ITC

The Investment Tax Credit and its Bonus Credits are a game changer for the economics of solar and solar+storage projects. Many projects are eligible for a baseline credit of at least 30% of the total solar or solar+storage project costs. By incorporating and stacking one or more bonus credits, some projects may even qualify for up to 70% of eligible project costs.

To take advantage of the ITC, homeowners must ensure their solar equipment meets specific criteria:

Meeting these criteria lays the foundation for a successful claim of the ITC, ensuring that an investment in solar energy is not only environmentally conscious but also financially rewarding. Note that the credit must be claimed the tax year when the equipment is installed, not the year of purchase. Always check the latest IRS guidelines or consult with a tax professional for the most current information.

In addition to the baseline 30% credit, the ITC also offers four bonus credits that can significantly enhance the financial benefits of your solar project. Stacking these bonus credits on top of the base credit allows for coverage of up to 70% of eligible project costs.

The Four Bonus Credits:

If met, this increases the value of the ITC from 6% of eligible project costs to 30%.

Offers between a 2% and 10% bonus credit for projects that meet domestic manufacturing requirements.

Offers 10% for projects located within an “energy community,” which is defined as:

Offers a credit of between 10 and 20% of eligible project costs for qualified solar and wind projects built in or that benefit low-income communities.

All four bonus credits are eligible for direct pay, meaning that non-taxpayers, such as local governments, government agencies, and nonprofit organizations, can receive their value as a cash payment.

Understanding and strategically leveraging these bonus credits can make a substantial difference in the overall economics of your solar and solar+storage projects.

Solar energy incentives change frequently and will not be available indefinitely. Solar incentives are developed in order to "incentivize" early adoption. In other words, the installation of a solar power system should be included in planning sooner rather than later for homeowners who want to lower their upfront solar equipment costs, increase their energy savings, lower their operating expenses, and reduce their carbon footprint.

Tax credits, including the ITC, are powerful tools not only to reduce tax liability but also to stimulate investment in clean energy. While they may pose certain challenges in terms of eligibility and application, the potential financial benefits make them a compelling option for those considering solar projects.

If you are thinking about investing in a solar project that might qualify for the ITC, you should consult with a tax professional to ensure you are eligible and understand the specific rules and requirements. They can provide personalized guidance, ensuring that you navigate the complex tax regulations with confidence and maximize the financial advantages available.

Installing a solar power system and taking advantage of the ITC is not just a wise financial move; it's a strategic and sustainable investment in the future.

Contact us to get connected with a solar installer near you.

Articles:

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

https://www.cleanegroup.org/how-to-make-the-most-of-the-investment-tax-credit-applying-for-bonus-credits/

https://www.carboncollective.co/sustainable-investing/investment-tax-credit-itc

https://www.thehartford.com/business-insurance/strategy/business-tax-credits/investment-tax-credits

https://impactcp.org/insights/what-are-investment-tax-credits/

https://turbotax.intuit.com/tax-tips/going-green/federal-tax-credit-for-solar-energy/L7s9ZiB4D

https://www.marketwatch.com/guides/solar/federal-solar-tax-credits/

IRS:

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

https://www.evergreenaction.com/blog/what-are-clean-energy-tax-credits

Find Policies and Incentives by State:

Living in Hawaii isn’t just about sun-kissed beaches; it’s also a paradise for those considering investments in renewable energy solutions. The state’s strong commitment to renewable energy, coupled with its traditionally high utility rates, present an opportunity for substantial savings. With an ambitious goal of achieving 100 percent renewable energy by 2045, Hawaii has introduced numerous incentives to turn this vision into reality. Residents who meet the criteria stand to benefit from Hawaii’s robust solar incentive programs, potentially saving over $10,000.

The popularity of solar panels in Hawaii continues to rise, thanks to the abundant sunshine that allows residents to harness solar power to meet their electricity needs while avoiding the environmental issues associated with fossil fuels. This, in turn, leads to a decrease in electricity bills, ensuring long-term cost savings. The state of Hawaii sweetens the deal by offering a variety of financial incentives, including tax credits, grants, and loans, making solar installation financially feasible for its residents.

Renewable Energy Technologies Income Tax Credit - A major incentive for Hawaii taxpayers who own solar panels. This substantial credit reduces state income taxes by 35% of the approved system cost and installation, with a maximum value of $5,000 per system. It is a one-time assessment during tax filing after installation, and any unused credits can be carried over to subsequent years. This credit can be stacked with the ITC for additional savings.

Federal Solar Investment Tax Credit (ITC) - Provides a credit to your income tax liability for 30% of your entire conversion cost. This includes panels, batteries, inverters, and labor. Assessed once during tax filing after installation, with unused credits carrying over for up to five years in total. On average, participants receive $4,406.

Community Renewable Energy Program - Allows homeowners access to community solar with a credit for all consumed energy. Enrolled customers continuously receive bill credits for the energy they pull from their community solar farm. Recipients receive $19,116 in credits on average, based on consumption and location.

GreenSun Hawaii - A solar financing option that minimizes interest rates and offers longer terms than loans offered outside of the program. The program’s goal is to provide financing options that will result in lower monthly payments compared to the customers' current utility bills.

Green Energy Money Saver (GEMS) Program - A financing program for low-income households, making solar energy systems more affordable and accessible. Participating customers can conveniently pay back the cost of installing solar equipment through their monthly utility bill with no upfront costs. The minimum financing amount for residential customers is $5000, with no specified maximum limits.

Battery Bonus Program - This program pays a cash incentive and bill credits to residential and commercial Hawaiian Electric customers who add battery storage to their solar systems. Participants must commit to using and exporting a set kilowatt amount for two consecutive hours daily. In return, they can receive three types of incentives: a one-time check for up to $4250, a monthly capacity bill credit of $25 for the 10-year duration of the program, and for non-Net Energy Metering customers, and a monthly export bill credit averaging $63. No new applications for the Battery Bonus program are being processed on Oahu as it has reached its maximum capacity of 40 megawatts. However, the program will remain available to Maui customers until June 30, 2024, or until a cap of 15 megawatts is reached.

Bring Your Own Device (BYOD) Program - Building on the success of the Battery Bonus program, a follow-up program, BYOD, will be open to Hawaiian Electric customers starting on March 1, 2024. This program provides incentives for customers to incorporate battery storage into new or existing solar systems. Participants are eligible for a one-time upfront payment of up to $500, or $1000 for those with low and moderate incomes. Additionally, there is a monthly capacity incentive of $5 to $10 per kilowatt depending on the level of commitment. Customers can also accumulate bill credits for controlled energy exports during specific periods designated by Hawaiian, referred to as BYOD events.

Net Energy Metering (NEM) - ONLY AVAILABLE TO CUSTOMERS WITH EXISTING NEM AGREEMENTS - The program provides credits towards future electric bills for any surplus energy generated by their systems and fed back into the grid. Participation in NEM can result in an average lifetime savings of just under $50,000. Hawaii also recently introduced the NEM Plus program, allowing NEM participants the flexibility to install new panels, battery storage, or a combination of both.

Local Incentives - Rebate programs and other incentives are offered by utility providers, specific cities, and other local entities. The savings vary based on the incentive, system size, and location.

Homeowners and some renters may qualify for federal and state tax credits for renewable energy-related expenses. These tax credits apply to various energy-efficient appliances, such as solar panels for generating electricity, backup power battery storage for home (with a capacity exceeding 3 kWh), solar water heating systems, and other approved energy efficiency enhancements.

The Clean Energy Investment Tax Credit (ITC) is available nationwide, providing property owners and occupants who install solar panels in residential or commercial properties with a federal tax credit equivalent to 30% of the project costs. While the incentive extends to secondary homes, landlords or other property owners who do not reside in the home are ineligible to claim the credit.

For those looking to install a solar system, the potential for savings is significantly enhanced by combining the various solar incentives with the ITC. This approach ensures that the financial benefits are maximized while contributing to a more sustainable and eco-friendly future. For more detailed information, it is recommended to consult with your tax advisor or accountant.

Claiming the federal credit is straightforward, but consult your tax professional to ensure eligibility. When you're ready to benefit from this advantage, follow these steps:

All receipts for labor and equipment should be kept on hand for filing purposes when claiming these credits come tax time.

Any individual or corporate taxpayer who is eligible to claim the renewable energy technologies income tax credit for 10 or more systems or distributive shares of systems installed and placed in service in a single tax year must fill out Form N-342 and attach it to their state tax return

Hawaii boasts more attractive solar programs than most other states. With solar incentives and rebate programs, Hawaiian taxpayers have the potential to save over $10,000 upfront. This means solar systems pay for themselves much faster leading to boosted energy savings over time.

Currently, over 17% of Hawaii’s energy is powered by solar and this number is expected to grow. By installing solar systems and leveraging these incentive programs, residents of Hawaii can actively contribute to a sustainable future while enjoying the financial benefits of abundant sunshine for years to come.

References

https://www.eesi.org/obf/case-study/hawaii

https://www.ecowatch.com/solar/incentives/hi

https://www.forbes.com/home-improvement/solar/hawaii-solar-incentives/

https://www.forbes.com/home-improvement/solar/hawaii-solar-incentives/

https://www.forbes.com/home-improvement/solar/hawaii-solar-incentives/

https://www.hawaiianelectric.com/products-and-services/customer-renewable-programs/rooftop-solar/battery-bonus

https://www.revolusun.com/battery-bonus/

Find Policies and Incentives by State:

_thumbnail.png)

“Eureka,” California’s state motto since 1963, meaning “I have found it,” resonates with state residents looking for financial savings and a reduced carbon footprint as they discover the Golden State’s robust solar programs and incentives. California is a leader in renewable energy, especially solar power. The state generates approximately 33% of the total solar supply in the United States, making it the highest solar producer in the nation. It has led the country in solar energy adoption over the past decade and provides a range of incentives to support homeowners in their transition to solar power.

California's solar programs go beyond promoting the adoption of solar panels and add-on battery storage - they also contribute to lowering the overall cost for homeowners. The appeal of solar in California is heightened by the state's efforts to increase accessibility, through thoughtfully designed programs catering to low-income households. California residents can rest assured that their solar investments are protected as the state has a set of laws in place, ensuring that homeowners' rights to own solar panels are secure. This promotes widespread solar access while preventing unnecessary restrictions. These measures make the sun-soaked state of California an ideal place to invest in solar energy.

The PACE program – known as the Home Energy Renovation Opportunity (HERO) program in California – provides an avenue to go solar with zero money down. It offers accessible solar financing, providing owners with affordable payment options. This agreement involves collaboration between local or state governments and traditional financiers, who fund the initial project costs. Homeowners then repay their local authority through an increased property tax bill, usually spread over 20 years.

Making it even more attractive, the obligation to settle the debt upon sale or refinance is removed. The high security of loan payments tied to the property tax bill contributes to low-interest rates, making the program a win.

The ITC, is a significant benefit, reducing the income tax burden by 30% of the total system installation costs. It’s important to note that California does not offer a specific state-level tax incentive for solar installations.

The federal solar tax credit covers a substantial portion of installation costs for a solar PV system. Currently set at 30%, this rate will remain until 2032, decreasing to 26% in 2033 and 22% in 2034. The credit is set to end by 2035 unless renewed by the federal government.

This program is a perk for homeowners with solar panels, enabling them to earn credits for any excess electricity they produce and send back to the grid. The credits can offset the electricity consumed from the grid during times when solar production is lower, resulting in additional savings on electricity bills.

California changed its net metering policy to Net Energy Metering 3.0 (NEM 3.0) last year. Under this revised policy participants have the opportunity to sell excess solar energy to local electric companies in exchange for power bill credits. By leveraging the new NEM 3.0 billing tariff alongside a solar plus battery system, participants can offset their power bill by as much as 70-90%.

In California, the property tax incentive for the installation of an active solar energy system takes the form of an exclusion, rather than an exemption. The Active Solar Energy Exclusion is categorized as a “new construction exclusion,” meaning that the installation of a qualifying solar energy system will not result in either an increase or a decrease in the assessment of the existing property. This exclusion applies to any active solar energy system constructed or completed before January 1, 2027. Even after the exclusion period ends, any solar energy system previously excluded as new construction will remain exempt from property tax until the property changes ownership.

The SGIP is an initiative that provides rebates for solar installations combined with battery storage. Those eligible for the SGIP rebate include residential customers of Pacific Gas and Electric Company, Southern California Edison, Southern California Gas Company, and San Diego Gas and Electric. Beyond the general program, two additional categories provide higher rebates: Equity and Equity Resilience. Participating in this program can result in substantial savings, approximately around $200 per kilowatt-hour (kWh) for solar battery systems.

Under the Equity category, eligible participants can benefit from a rebate that covers approximately 85% of the cost of an average energy storage system. For those who qualify for the Equity Resiliency category, the rebate goes even further, covering close to 100% of the cost of an average energy storage system.

This program offers subsidies for the installation of solar energy systems ranging from 1 to 5 kilowatts. This initiative is specifically designed to assist homeowners who may face financial constraints that would otherwise make solar installation unaffordable. For eligible homeowners, DAC-SASH provides nearly cost-free installation, presenting an opportunity to save up to $3 per watt through upfront solar rebates.

The federal and state solar tax incentives in California emerge as the best options for saving money and maximizing returns with a solar array. Additionally, there are some local incentives available, depending on location and the utility company that services the property, which can further enhance the benefits. Most of these local incentives are easy and quick to apply for and can save participants hundreds or even thousands of dollars, so they’re well worth the time and effort it takes to enroll. More details can be found at https://www.consumeraffairs.com/solar-energy/california-solar-incentives.html

California residents are in luck as they have the opportunity to benefit from various tax incentives by opting to install solar systems. These incentives enable both home and business owners to deduct a portion of the installation expenses from their tax obligations. Once the solar system is installed, the owner assesses the overall eligible cost, multiplying it by the tax credit rate. This determines the exact credit amount available for deduction from the individual or business's total tax liability for the given year. It's a straightforward way for Californians to reap the benefits of solar energy while enjoying some tax relief.

There is no state tax credit for solar equipment in California, but all California residents are eligible for the federal investment tax credit. This federal incentive grants an income tax credit equal to 30% of the entire installation cost. On average, this tax credit alone can save participants just under $5,000, provided they owe enough in taxes to utilize the entire credit. The state offers other solar incentives — like net metering and solar financing programs — which can be combined with the ITC to maximize returns on solar installation.

An October 2023 survey by the MarketWatch Guides team indicates that around 91% of 120 California residents surveyed have used at least one incentive to reduce the cost of solar panel installations. Despite the state's reduction in net-metering credits, there are still opportunities to save money, especially when opting for high-performing solar panels paired with solar storage.

It is recommended that applicants review each program’s requirements, prepare all necessary documentation in advance, and seek guidance from a tax professional or the solar power installer.

Applicants must contact their PACE program administrator. The Department of Financial Protection & Innovations (DFPI) provides a list of program administrators.

Provide the required information, which may include contact information, an income verification letter from the applicant’s employer, tax returns from previous years, and other documents.

Connect with a PACE-approved solar panel installation company through the program administrator.

Move through the solar installation process with the installer and then provide the final details to the program administrator.

Applicants must fill out IRS form 5695 from the IRS’s website.

Prepare documents: these may require information about the solar installer, the capacity of the solar system, and the address where the system is installed.

Applicants should file the completed form alongside their taxes.

Applicants must request an interconnection application from their electric company.

Fill out the application. Applicants will need to supply information about the system capacity, the expected generation, and the installer’s contact information.

Pay the interconnection application fee. This might be included in the solar installer’s estimate, so check before paying it separately.

Submit the application and proceed with the rooftop solar installation.

Once the system is installed and connected, the utility provider will likely need to inspect the connection before approving the applicant for net metering.

If a developer installs an active solar energy system while constructing a new building, the initial purchaser of that building may receive the exclusion if:

Applicants begin by checking eligibility on the GRID Alternative website. They must own a home in California to qualify for this program.

A program administrator will reach out to obtain any documentation required, including an income verification.

A program administrator will walk applicants through the next steps, which include finding a certified installer and getting the system installed and running.

California, famous for its breathtaking beaches, iconic surf, abundant sunshine, and majestic mountains, has a rich history of embracing its natural wonders. With a strong commitment to environmental consciousness, it’s no surprise that the Golden State is at the forefront of the renewable energy movement. The state’s solar incentives make going solar an easy and appealing choice for residents, saving them money while moving towards a greener future and brighter future, all while preserving the natural beauty that defines California. For more information on California’s solar incentives please seek guidance from a tax professional or your solar power installer.

https://todayshomeowner.com/solar/guides/california-solar-incentives/

https://www.consumeraffairs.com/solar-energy/california-solar-incentives.html

https://www.forbes.com/home-improvement/solar/california-solar-incentives/

Find Policies and Incentives by State:

In an energy storage system, “closed loop” refers to the digital communication and control between different components from different manufacturers.

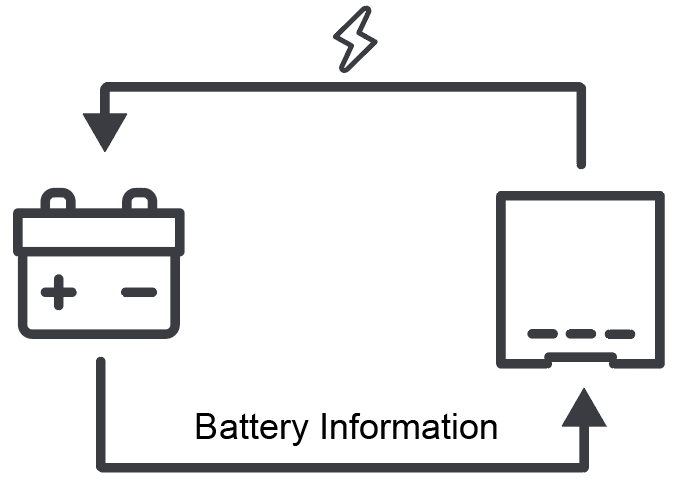

In a battery energy storage system (BESS), the battery management system (BMS) shares with the inverter-charger the battery's present state of charge (SOC), voltage, current and cell temperature as well as the requested charge voltage and current. The inverter-charger uses the information shared by the BMS to adjust its charge settings, thereby closing the loop (see diagram below).

Figure 1. Closed-Loop Communication

Conversely, an “open loop” system refers to a charging system where the battery BMS does not share information with the inverter-charger during the charging process. In an open-loop system, you must manually program the inverter-charger with fixed charge parameters. And potentially use external tools, such as a battery shunt or temperature compensation sensor, to give the inverter-charger information about the current, battery temperature, and calculated battery SOC.

A closed-loop charging system offers many benefits.

Closed-loop charging supports battery safety by enabling features embedded in the BMS to interact with the charging system’s controls. This typically results in alarms or warnings requesting to stop the charge or discharge.

Given the automatic communication of the parameter values, the configuration of a closed-loop charging system is much easier than the manual process of configuring settings for an open-loop system.

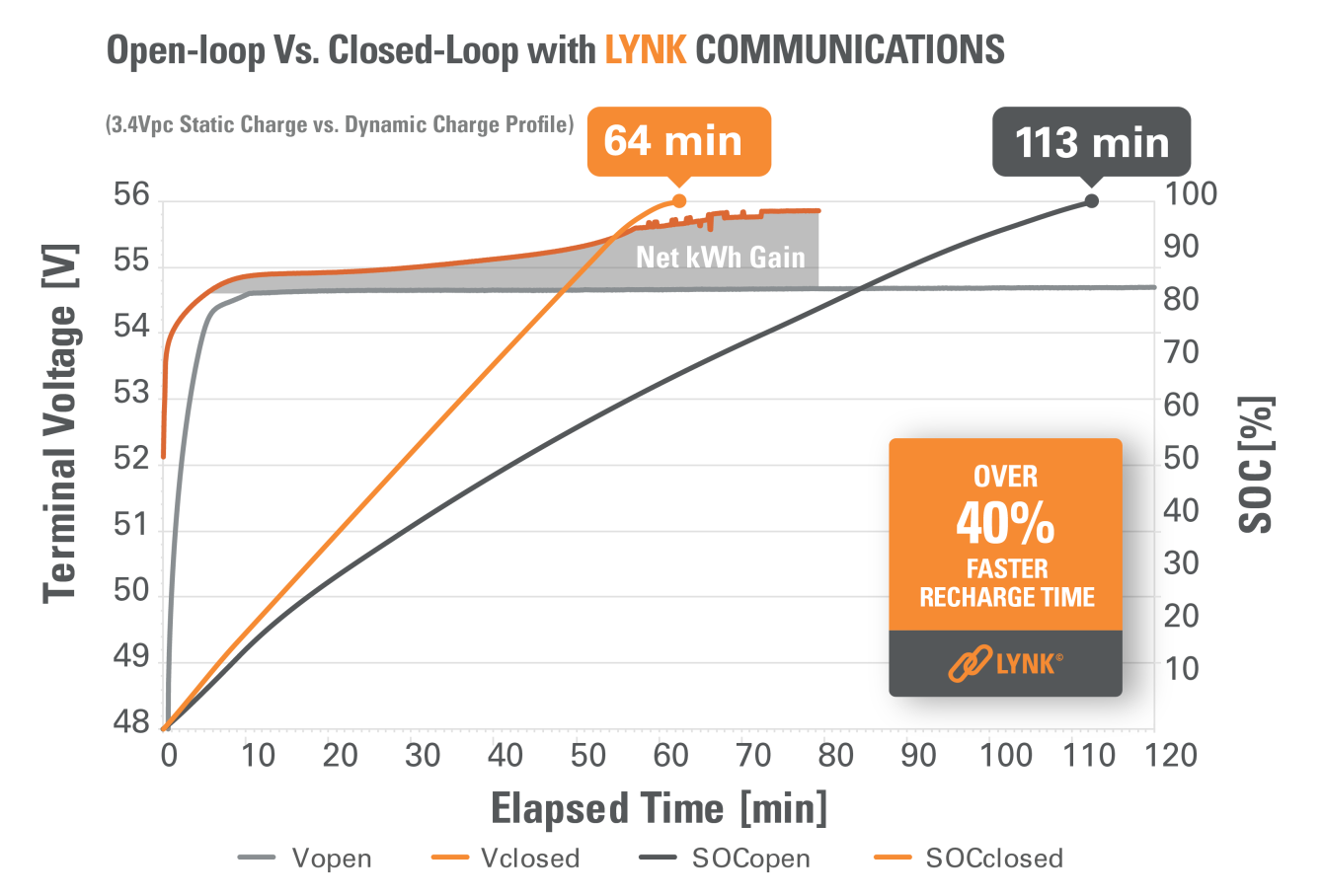

A closed loop system enables the communication of dynamic charge voltage requests, which can speed up the charging process. Up to 25 to 40% faster than open loop charging.

A closed-loop system can allow the inverter-chargers monitoring system to display accurate battery SOC and other parameters provided by the BMS.

A BMS in a closed-loop charging system can communicate with other devices in the system enabling safety mechanisms. Typically, the BMS prevents charging when there is over-temperature, under-temperature, over-voltage, or over-charge current. The BMS also typically prevents discharge when there is over-temperature, under-temperature, under-voltage or over-discharge current. Except for an under voltage condition, the BMS In a closed-loop system can also communicate that the issue has been cleared and automatically enable discharging or charging to resume.

For example, if a lithium battery is charged when it is below 0 °C (32 °F), the battery loses capacity and its internal resistance is permanently increased before ultimately failing. To avoid under-temperature charging, the BMS in a closed-loop system can terminate the charging process when the battery cell temperature is below 0 °C (32 °F) and restart when cell temperatures rise above the threshold.

A good example of this is the BMS in Discover’s AES RACKMOUNT lithium battery, which is configured to operate only in a safe temperature range. It stops receiving a charge when the battery cell temperature is below 4 °C (39.2 °F) and only resumes charging after 120 seconds have elapsed and the battery cell temperature is 4 °C (39.2 °F) or higher. Discover also offers a AES RACKMOUNT battery model that comes with internal heating that allows it to maintain operating in colder climates.

A closed-loop system minimizes the amount of setup required by enabling the BMS to automatically communicate the charging parameters to the inverter-charger.

To enable closed-loop communication, the BMS must use the correct inverter-charger protocol and be hardwired, usually by CAT5 cable, with the inverter-charger. Many batteries come pre-installed with the preferred protocol. However, the wiring of CAN High, CAN Low, and CAN Ground and serial cable signals differ between inverter chargers. This can often be confusing to installers and requires the ability to crimp and install custom CAT5 crossover cables correctly. Always, refer to the inverter-charger documentation for wiring information.

Batteries networked in closed-loop communication with the power conversion system must also take into account the state of charge across multiple batteries which is often coordinating the output of multiple inverter-chargers. How battery data is amalgamated and whether an inverter-charger acts as a client or server needs to be coordinated. To do this many Lithium batteries require the manual setup of the master-slave relationship between batteries and power conversion equipment using DIP switches on the battery modules.

An advantage offered by Discover’s lithium battery systems is the LYNK II Communication Gateway, which supports closed-loop communication between Discover Lithium batteries and various brands of inverter chargers. The LYNK II provides a protocol gateway between the inverter-charger network and the Discover Lithium battery network.

LYNK II is also used to select signal wiring requirements of the inverter-charger so that no crossover CAT5 cables are required. In most cases, no further setup is required, as Discover lithium batteries manage the battery network automatically.

Figure 2. LYNK II between a Discover Lithium Battery Network and the inverter Protocol Network.

In addition to communicating basic battery information, such as the battery capacity, battery SOC, and maximum charge parameters (voltage, current), some inverter chargers support receiving dynamic charge requests from the battery.

Dynamic Charging in a closed-loop system enables faster charging than is normally possible with the conservative static charge voltage targets used by an open-loop system. Lithium batteries with Dynamic Charging firmware continually send to the inverter-charger the safe, but optimized voltage and current

settings. In a closed-loop system, the inverter-charger receives these parameters and dynamically adjusts the charge settings.

With dynamic charging, the system automatically adjusts to overcome voltage losses due to cable and terminal resistance and balances the cells at the end of the charge cycle. This results in a longer bulk phase (maximum current) and a shorter absorption phase.

The graph below compares both the static charging and dynamic charging of a Discover Lithium Battery.

Figure 3. Open-Loop vs. Closed-Loop charging times of a Discover Lithium Battery.

The balancing of battery cells reduces the uneven aging of the cells.

At the end of the charge cycle, as the battery approaches 100% SOC, the BMS adjusts down the overall charge current but forces voltage to rise slightly causing any cell that has diverged from the lowest voltage cell to continue absorbing current safely.

Unfortunately, in an open-loop charging system, maintaining a high target balancing charge voltage often causes individual cells to trigger battery over-voltage protection, which prematurely stops the overall cell balancing process. This results in a shorter balancing period with cells remaining unbalanced. This shortens the useful battery life.

A BMS with Dynamic Balancing controls the target voltage to within a safe range avoiding the premature stoppage of the process. The result is a longer, more thorough cell-balancing process that delivers the longest useful battery life possible.

The BMS delivers safety, allowing the battery to operate only within acceptable limits. The BMS will provide charge parameters to the inverter-charger in a close-loop system enhancing safety and simplifying system configuration. Some BMS will also deliver fast dynamic charging, and dynamic cell balancing in a closed-loop system.

For information about the batteries offered by Discover Energy Systems, please visit: https://www.discoverlithium.com